Navigate Dubai’s Dynamic Real Estate Landscape and Discover Key Insights and Statistics

Key Insights:

- Dubai’s real estate market is expected to grow 5 – 8% annually, with rental yields averaging 7%.

- In 2023, transaction values jumped 34% to AED 151 billion, with 60% of sales coming from off-plan properties.

- Q2 2024 saw a record-breaking 39,000 transactions, with 33,000 apartment sales, mainly one-bedroom units.

- Dubai boasts diverse property types. Residential apartments, luxury villas, and commercial properties dominate key areas like Downtown Dubai, Dubai Marina, and Business Bay.

- The city offers high rental yields. Affordable areas like International City (8.37%) and Jumeirah Village Circle (7.04%) offer strong rental returns.

- Indian, British, and Chinese buyers led foreign property investments in 2023.In recent years, Dubai has been prioritizing sustainable real estate solutions.

- The UAE has over 550 LEED-certified projects, with initiatives like The Sustainable City promoting eco-friendly developments.

- The Dubai 2040 Urban Master Plan integrates smart home technologies and digital transformation for sustainable growth.

An Overview of Dubai’s Real Estate Market

The Dubai real estate market is one of the most dynamic and sought-after in the world, known for its luxury developments, high rental yields, and investor-friendly policies.

The market offers a diverse range of properties, from high-end villas on Palm Jumeirah to ultra-modern apartments in Downtown Dubai.

Dubai’s real estate sector benefits from tax-free property ownership, residency incentives, and strong infrastructure development. In recent years, demand has surged due to foreign investment, economic diversification, and population growth.

The city’s strategic location between Europe, Asia, and Africa makes it a global business hub, further driving demand. Additionally, world-class infrastructure, including modern transport networks and smart city initiatives, enhances its appeal.

The market is influenced by global economic trends, government regulations, and Expo 2020’s long-term impact.

With ongoing mega-projects like Dubai Creek Harbour and Mohammed Bin Rashid City, Dubai continues to attract buyers looking for premium real estate opportunities.

Key Statistics on Dubai’s Real Estate Market

Dubai’s real estate market is set for strong growth in 2025, with prices expected to rise by 5 – 8% annually and rental yields averaging 7%, according to DAMAC Properties.

Transaction values surged 34% (AED 151 billion) in 2023, with 60% of sales from off-plan properties and driven by luxury demand.

In Q2 of 2024, Dubai’s real estate market saw a record-breaking 39,000 property transactions. Apartment sales led these transactions with 33,000 sales, particularly one-bedroom units.

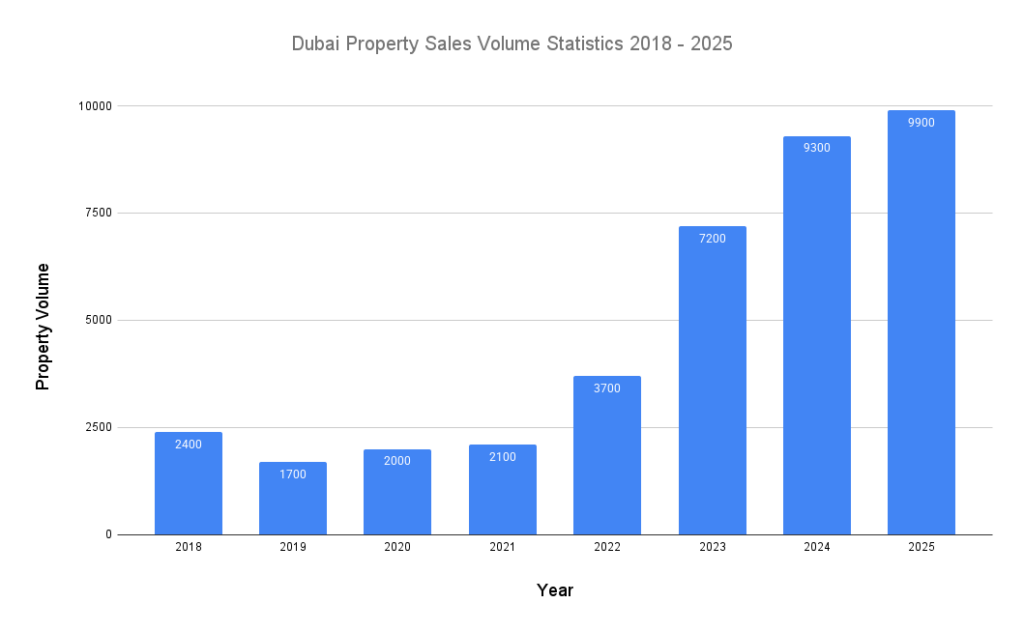

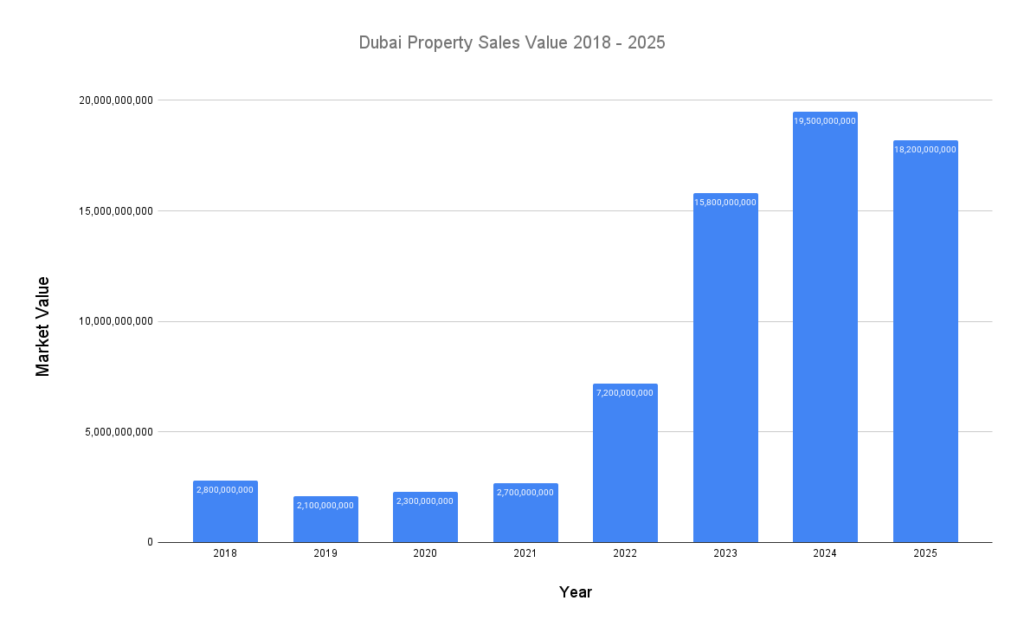

Here are detailed charts to give you a clear picture of Dubai real estate market statistics from 2018 – 2025 as reported by DXB Interact:

Breakdown of Property Types

Dubai’s real estate market offers diverse property types, including residential, commercial, and luxury real estate, catering to investors and homeowners alike.

Here’s a breakdown of property types in Dubai:

Residential Properties

Apartments and villas dominate the market, with high demand in areas like Downtown Dubai, Dubai Marina, and Jumeirah Village Circle. Apartments, particularly one-bedroom units, lead sales due to affordability and rental yields.

Commercial Properties

Office spaces, retail units, and warehouses are thriving, especially in Business Bay and DIFC (Dubai International Financial Centre).

The demand for premium office spaces has surged, driven by Dubai’s growing business ecosystem and influx of multinational companies.

Luxury Real Estate

This segment has seen remarkable growth, fueled by high-net-worth buyers and foreign investors.

Prime areas such as Palm Jumeirah, Emirates Hills, and Dubai Hills Estate offer exclusive villas and penthouses. Ultra-luxury developments, including branded residences, continue to drive market expansion.

Dubai’s diverse real estate landscape ensures strong investment potential across all property segments, making it a global real estate hotspot.

Trends in Property Prices and Rental Yields

Dubai’s property market offers attractive rental yields, averaging between 5% and 9%, making it a lucrative investment destination.

Affordable areas like International City and Dubai Production City lead with yields of approximately 8.37% and 8.89%, respectively.

Mid-tier neighborhoods such as Jumeirah Village Circle (JVC) also perform well, offering yields around 7.04%.

In contrast, prime locations like Downtown Dubai and Dubai Marina provide yields ranging from 5% to 8%, depending on property type and location.

These variations highlight the importance of area selection in maximizing investment returns.

| Property Prices and Rental Yields in Dubai 2024 – One-Bedroom Units | |||

| Area | Property Price | Rental Price / Month | Rental Yield |

| Downtown Dubai | $653,416 | $3,403 | 6.25% |

| Dubai Marina | $496,869 | $2,722 | 6.57% |

| Palm Jumeirah | $996,460 | $3,856 | 4.64% |

| Jumeirah Village Circle (JVC) | $295,943 | $1,735 | 7.04% |

| Business Bay | $457,404 | $2,665 | 6.99% |

| International City | $167,168 | $1,166 | 8.37% |

| Dubai Production City | $168,459 | $1,248 | 8.89% |

Popular Areas for Real Estate Investment

Dubai offers numerous prime locations for real estate investment, with high demand for off-plan projects and waterfront properties.

Here are some of the best areas for real estate investment in Dubai:

- Palm Jumeirah – Known for its ultra-luxury villas and waterfront apartments, Palm Jumeirah remains a top choice for high-net-worth investors. The island’s exclusivity and premium amenities drive strong capital appreciation.

- Dubai Marina – A favorite among expatriates and investors, Dubai Marina offers high rental yields, averaging 6% – 8%. Its vibrant lifestyle, waterfront views, and proximity to business hubs make it a highly desirable area.

- Business Bay – As a leading commercial and residential district, Business Bay attracts professionals and investors. With ongoing infrastructure developments and high-end off-plan projects, property values continue to rise.

- Downtown Dubai – Home to the Burj Khalifa and Dubai Mall, Downtown Dubai is a luxury real estate hub. High-end apartments and penthouses here offer strong rental returns and capital growth.

- Jumeirah Village Circle (JVC) – A fast-growing community with affordable apartments and townhouses. JVC is ideal for mid-range investors seeking high rental yields and long-term appreciation.

- Arabian Ranches – A premier villa community. Arabian Ranches appeals to families with its spacious homes, green landscapes, and high-end lifestyle, ensuring steady property value appreciation.

Off-Plan vs. Ready Properties in Dubai

Investors in Dubai can choose between off-plan properties and ready-to-move-in units, each offering distinct advantages.

Off-Plan Properties

These are purchased before completion, often at lower prices with flexible payment plans.

Investors benefit from potential capital appreciation, but risks include construction delays and market fluctuations. Choosing reputable developers is crucial to ensuring project completion and quality.

Ready Properties

These units offer immediate rental income and occupancy, making them ideal for investors seeking quick returns. While prices are generally higher than off-plan properties, they come with less risk and immediate market value stability.

The decision depends on an investor’s goals – off-plan suits long-term appreciation, while ready properties provide instant revenue. A careful assessment of developer reputation and market trends is essential for a successful investment.

Impact of Expo 2020 and Beyond

Expo 2020 had a transformative impact on Dubai’s real estate market, driving demand, infrastructure growth, and foreign investment. The event attracted millions of visitors, boosting tourism, business activity, and property sales.

Key areas such as Downtown Dubai, Business Bay, and Dubai South experienced increased investor interest, leading to higher property values and rental yields.

Post-Expo, Dubai continues to benefit from enhanced infrastructure and economic diversification. Mega-projects like Dubai Creek Harbour, set to become a new waterfront hub, and Expo City Dubai, a sustainable smart city, are shaping the future of real estate.

The momentum from Expo 2020 has solidified Dubai’s status as a global investment hotspot, ensuring long-term growth in its property market.

Foreign Investment in Dubai’s Real Estate

Dubai’s real estate market has become increasingly attractive to foreign investors, particularly expatriates, due to policies that facilitate foreign ownership.

The introduction of freehold zones allows non-UAE nationals to fully own, buy, sell, and lease properties in designated areas. These include Dubai Marina, Downtown Dubai, and Palm Jumeirah, among others.

In 2023, foreign nationals accounted for a significant share of property transactions in Dubai.

Indian nationals emerged as the leading investors, contributing approximately AED 3.04 billion through 1,293 investments in the first quarter. British and Russian buyers also played prominent roles, ranking second and third respectively.

These trends underscore Dubai’s appeal as a global investment hub, driven by favorable ownership laws and a diverse real estate market.

Sustainability Trends in Real Estate

Dubai’s real estate sector is witnessing a significant shift towards sustainability, with a growing emphasis on green buildings and eco-friendly developments.

Developers are increasingly prioritizing energy-efficient designs. They incorporate features such as solar panels, water recycling systems, and smart energy management technologies.

This trend aligns with Dubai’s ambitious sustainability goals, including the UAE’s Net Zero 2050 initiative. This project aims to reduce carbon emissions and promote environmental stewardship.

The demand for LEED-certified properties has surged, reflecting a market preference for buildings that meet rigorous environmental standards.

As of recent reports, the UAE boasts over 550 LEED-certified projects, positioning Dubai among the top cities globally for green-certified buildings.

A notable example of sustainable development is The Sustainable City. This is a community designed to minimize environmental impact through renewable energy, green spaces, and resource-efficient infrastructure.

Such initiatives not only contribute to environmental conservation but also enhance property values and attract eco-conscious investors.

As Dubai continues to integrate sustainability into its urban planning, the real estate market is expected to see a proliferation of eco-friendly properties. And these cater to the increasing demand for sustainable living options.

Challenges and Risks in Dubai’s Real Estate Market

Dubai’s real estate market faces challenges such as market oversupply, price volatility, and regulatory changes. An anticipated influx of over 72,300 residential units in 2025 may lead to oversupply, potentially affecting property values.

Price volatility, influenced by economic shifts and policy changes, poses risks for investors.

To stabilize the market, Dubai has introduced measures like the Smart Rental Index 2025. This utilizes artificial intelligence and real-time data to determine fair rental values, ensuring a balanced and transparent market for both landlords and tenants.

In order to mitigate investment risks, here are some things to keep in mind:

- Conduct thorough market research to understand current trends and future projections.

- Diversify investments across different property types and locations.

- Stay informed about regulatory changes to ensure compliance and adapt strategies accordingly.

- Consult with local real estate experts for insights and guidance tailored to Dubai’s dynamic market.

Future Outlook for Dubai’s Real Estate Market

Dubai’s real estate market is poised for significant advancements, emphasizing digital transformation and smart home technologies.

The city’s strategic initiatives, such as the Dubai 2040 Urban Master Plan, aim to position Dubai as a global leader in real estate innovation by 2040.

This comprehensive plan focuses on sustainable urban development, integrating smart technologies to enhance residents’ quality of life.

The rise of smart homes, featuring automated systems for lighting, climate control, and security, reflects this trend.

These developments align with Dubai’s vision to create a sustainable and technologically advanced urban environment. In the long haul, these will attract investors and residents seeking modern, eco-friendly living solutions.